News

Guide Renting with Pets in Ho Chi Minh City

02 Oct, 2025

Essential guide to renting with pets in Ho Chi Minh City — rules, costs, pet-proofing tips, training, and neighborhood insights to help expats and locals live comfortably.

Learn more

Your Guide to Renting an Apartment with Pets in Ho Chi Minh City

02 Oct, 2025

Comprehensive guide to renting pet-friendly apartments in Ho Chi Minh City — rules, amenities, top districts, and tips to help expats and locals live comfortably with pets.

Learn more

The Ultimate Apartment Inspection Checklist in Ho Chi Minh City

02 Oct, 2025

Essential apartment inspection checklist for Ho Chi Minh City rentals — helps tenants and landlords document condition, protect deposits, and avoid disputes.

Learn more

Handling Tenant Move Out in Your Apartment Quickly and Efficiently

01 Oct, 2025

Handle tenant move-out in HCMC with clear steps: notice, inspection, deposit return, legal compliance, and smooth prep for next renter. Full guide here.

Learn more

Vietnam Temporary Residence Card: Types, Rules, and Rights

01 Oct, 2025

Vietnam TRC grants expats 1–5 years of legal stay, multiple entry, rights to housing, banking, and family reunion. Full guide on rules and renewal.

Learn more

Vietnam Temporary Residence Card (TRC) – Full Guide for Foreigners

01 Oct, 2025

Vietnam TRC grants foreigners 1–5 years of legal stay, multiple entry, easier banking, housing, and work stability. Full guide for expats in HCMC.

Learn more

Temporary Residence Registration for Foreigners in Vietnam

01 Oct, 2025

Foreigners in Vietnam must register residence within 24–48h or apply for a TRC (1–5 years) for long-term stays. Ensure compliance, avoid fines.

Learn more

Overview of Temporary Residence in Vietnam

01 Oct, 2025

Foreigners in Vietnam must register residence: short-term within 24–48h, or get a TRC (1–5 years) for work/investment. Avoid fines, ensure legal stay.

Learn more

Temporary Residence Registration in Vietnam

01 Oct, 2025

Temporary residence registration in Vietnam is mandatory for foreigners. Landlords must declare within 24h; tenants provide passport, visa, and lease. Non-compliance risks fines.

Learn more

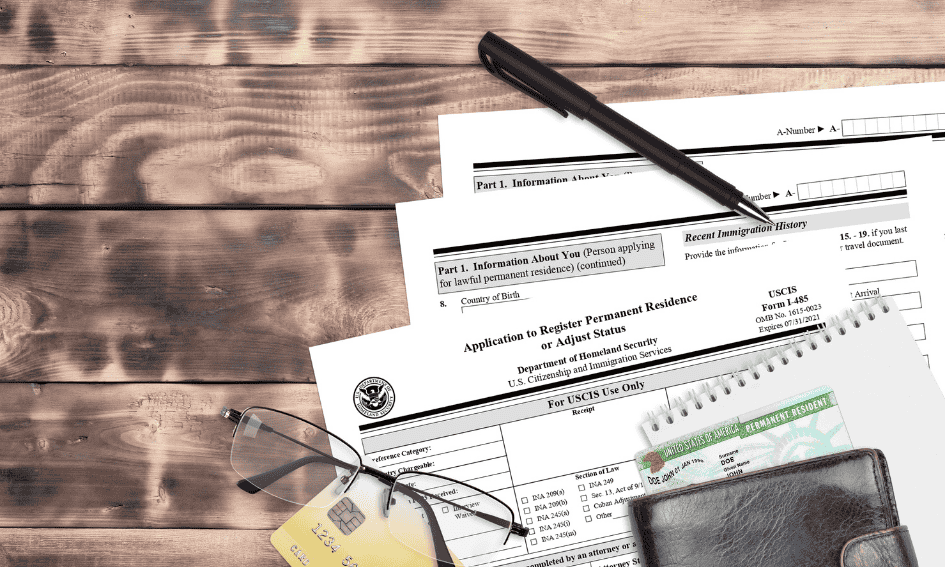

Maximizing Your Investment: Understanding Real Estate Taxes for Foreign Buyers in Vietnam

01 Oct, 2025

Foreign buyers in Vietnam face 10% VAT, 0.5% registration fee, 5% PIT + 5% VAT on rentals, and 2% PIT on transfers. Smart tax planning maximizes long-term returns.

Learn more

A Guide to Tax Obligations for Non-Resident Property Owners in Vietnam

01 Oct, 2025

Non-resident property owners in Vietnam pay 2% PIT on sales, 5% PIT + 5% VAT on rentals (if >100M VND/year), plus fees. DTAs help avoid double taxation

Learn more

Tax Policy on Personal House Rental in Vietnam

01 Oct, 2025

Tax on personal house rentals in Vietnam: 5% VAT, 5% PIT, plus license fee (300k–1M VND/year). Exempt if income <100M VND/year. Clear filing ensures compliance.

Learn more